In today’s fast-paced economy, few companies capture the imagination of investors quite like MOZG. Positioned at the forefront of resource-driven innovation, MOZG is more than just a tech startup—it’s an expansive ecosystem that unites groundbreaking ideas with robust financial structures to fuel sustainable growth. Drawing upon its unique MOZG UNIT mechanism, rigorous auditing standards, and global partnership framework, MOZG offers investors a transparent roadmap to harness the next wave of technological and economic transformation. Below, we explore the core elements of MOZG’s business model and its ambitious growth strategy, highlighting how the company seeks to redefine both scalability and investor returns.

1. Overview: A Resource-Driven Business Model

1.1 Anchored in Tangible Value

Unlike many conventional or crypto-based enterprises, MOZG’s value proposition is grounded in real-world resources and verifiable product potential. By tying each MOZG UNIT to tangible assets and services within the MOZG Exchange, the company has created a stable economic environment free from uncontrolled speculation and inflationary spirals. This resource-driven approach mitigates risks and provides investors with a clear line of sight into how and why the ecosystem generates value.

1.2 Centralized Regulation, Global Reach

MOZG maintains a centralized and regulated structure that keeps oversight of each transaction. By combining global regulatory frameworks with in-house audits, MOZG ensures all participants—from early-stage startups to major institutional backers—can trust the integrity of its ecosystem. The resulting global footprint allows the company to connect with a wide range of industries (AI, biotech, blockchain, and beyond), leveraging each sector’s highest-potential opportunities without sacrificing security or compliance.

2. The MOZG UNIT: Engine of the Ecosystem

2.1 Fueling Secure Transactions

Central to MOZG’s business model is the MOZG UNIT, a proprietary measure that underpins all economic activities within the network. Engineered to reflect authentic market worth, this innovative unit ensures each transaction is backed by resources rather than mere speculation. As investors acquire MOZG UNITs, they gain direct exposure to the ecosystem’s collective potential, benefiting from rising demand and broader adoption across multiple verticals.

2.2 Simplifying Inter-Company Exchanges

Within MOZG’s ecosystem, individual partner companies may issue their own specialized tokens to represent intellectual property or unique product offerings. The MOZG UNIT seamlessly serves as a universal exchange medium, eliminating the need for multiple trading pairs and slashing transaction complexities. For investors, this “one-stop” framework translates into streamlined trading, reduced fees, and a user-friendly environment conducive to both short-term trades and long-term holds.

3. Growth Strategy: A Phased Approach to Scalability

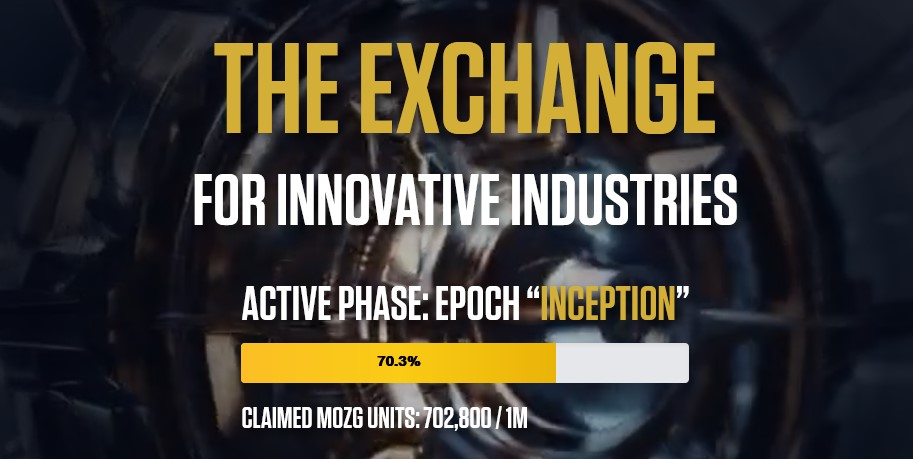

3.1 Epoch Expansions for Strategic Funding

MOZG’s growth plan unfolds in clearly defined “Epoch” phases, each multiplying the total supply of MOZG UNITs by 10×. While 30% of the newly minted units become available to the public, 70% remain retained for operational stability, strategic partnerships, and ecosystem development. By controlling inflation through incremental supply releases and routine audits, MOZG safeguards the health of the ecosystem while continuously fueling innovation.

Key Benefits of Phased Expansions

-

Predictable Liquidity: Each phase injects liquidity in a controlled manner, attracting new capital without destabilizing existing holdings.

-

Milestone-Based Triggers: Expansion epochs are tied to concrete achievements (product launches, upgrades, or partnerships), ensuring tangible progress aligns with token release.

-

Investor Visibility: Transparent reporting on supply distribution, locked reserves, and usage of funds fosters confidence among both retail and institutional investors.

3.2 From Inception to Infinity

These epochs—from “Inception” to “Infinite”—illustrate how MOZG scales responsibly. Early investors can enter at modest prices, capturing upside as the company matures and markets recognize the underlying value. Later phases accommodate wider institutional investment, deeper liquidity, and mainstream adoption. In doing so, MOZG’s business model offers consistent momentum, transforming early movers into long-term stakeholders who reap cumulative gains at each growth stage.

4. Diversifying Opportunities & Minimizing Risks

4.1 Rigorous Audits and Compliance

To protect both investors and partner companies, MOZG employs an audit protocol that verifies each project’s legitimacy and growth potential. By filtering out higher-risk or underdeveloped ideas, MOZG preserves the integrity of its ecosystem, ensuring that incoming capital funds only viable, well-researched ventures. This focus on compliance and due diligence reassures investors looking for stable returns rather than speculative hype.

4.2 Multi-Industry Integration

The company’s broad partnership network spans artificial intelligence, healthcare, finance, and beyond, allowing MOZG to curate a well-diversified project portfolio. As new collaborations form, the ecosystem’s underlying value grows, further boosting demand for MOZG UNITs. Investors, in turn, gain diversified exposure without having to manage multiple investments across various sectors independently.

5. Building Long-Term Shareholder Value

5.1 Steady ROI through Ecosystem Expansion

As the MOZG Exchange welcomes new game-changing founders and high-potential startups, the overall value of MOZG UNIT is likely to rise alongside increased trading volumes and user adoption. This self-reinforcing cycle positions investors for long-term ROI, allowing them to benefit from repeated expansions and broadening market traction.

5.2 Synergy of Equity and Token Investments

In addition to purchasing MOZG UNITs, investors have the option to participate in equity offerings, deepen their involvement through direct partnerships, or co-develop tailored AI solutions with MOZG’s R&D teams. By blending equity stakes and token-based investments, MOZG accommodates multiple risk profiles and strategic preferences.

6. Conclusion: A Blueprint for Sustainable, Scalable Growth

MOZG’s approach—a carefully calibrated blend of resource-driven tokenomics, phased expansions, and diversified partnerships—creates a compelling proposition for forward-thinking investors. Through rigorous auditing, centralized oversight, and a global outlook, MOZG optimizes both security and profitability. The resulting ecosystem stands as a testament to modern, scalable business practices, where each new milestone elevates the collective value for companies and investors alike.

If you’re seeking a strategic entry point into a $10 trillion tech revolution that values authenticity, rigorous oversight, and meaningful returns, MOZG offers an unparalleled opportunity. Its clear, phased roadmap and robust governance model ensure that your investment directly contributes to scalable innovation across industries—all while minimizing volatility and safeguarding long-term stability.

Ready to Learn More?

Discover how MOZG can transform your investment portfolio, unlock new market opportunities, and reshape the future of innovation.

Visit MOZG’s Main Page